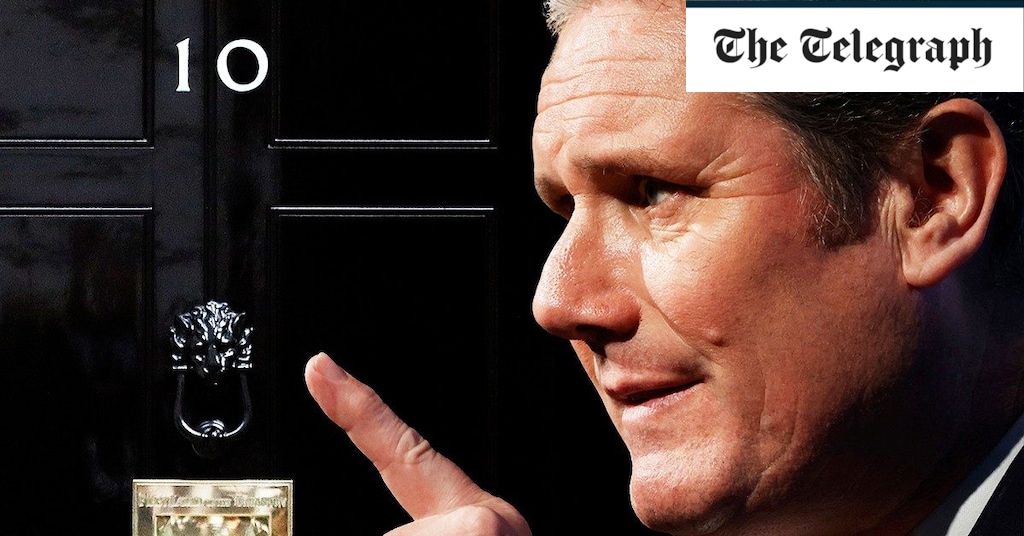

Labour’s recent election victory has left many middle-class Britons concerned about potential changes to their finances under the new government. With Sir Keir Starmer’s promises to add VAT to private school fees and abolish the “non-dom” status, there is growing anxiety about looming tax increases. As a result, some individuals are already considering relocating abroad to avoid a possible tax grab by the Labour government.

For those with children attending private schools, the prospect of a 20% increase in fees due to VAT could be a significant financial burden. Considering options abroad, Switzerland emerges as an attractive choice with its high-quality international schools and favorable tax rules. The country offers a range of educational institutions, from prestigious schools like Le Rosey to more affordable options like Collège du Léman International School. Additionally, Switzerland’s tax system, with varying rates in different cantons, provides opportunities for tax savings for expatriates.

Spain is another appealing destination for families looking for quality education at a lower cost. The country boasts several cities with affordable international schools, making it a popular choice among expats. Schools like King’s College Soto de Viñuelas in Madrid offer top-tier education at competitive fees. Moreover, Spain’s visa options make it accessible for those looking to relocate for educational purposes.

For individuals benefiting from the “non-domiciled” tax regime, the proposed changes by Labour could prompt a move to tax-friendly destinations like Dubai and Abu Dhabi in the UAE. These cities offer a tax-free environment for income and capital gains, making them attractive for high-earners seeking to minimize their tax liabilities. However, it is essential to adhere to UK tax laws regarding residency to avoid potential pitfalls when relocating to tax havens.

Retirees concerned about potential changes to pension tax relief in the UK may consider moving abroad to secure their retirement income. Countries like Portugal, Italy, and Malta offer favorable tax regimes for expat retirees, allowing for tax-efficient management of pension funds and foreign income. Italy’s forfeit regime and Malta’s Retirement Program are popular choices among retirees seeking tax benefits and a comfortable lifestyle in retirement.

Ultimately, the decision to relocate abroad for tax purposes requires careful consideration of individual circumstances and consultation with tax specialists. While moving overseas can offer tax advantages, it is essential to understand the implications and requirements of living in a foreign country. By exploring the options available and seeking expert advice, individuals can make informed choices to protect their finances in light of potential tax changes in the UK.